All Categories

Featured

Table of Contents

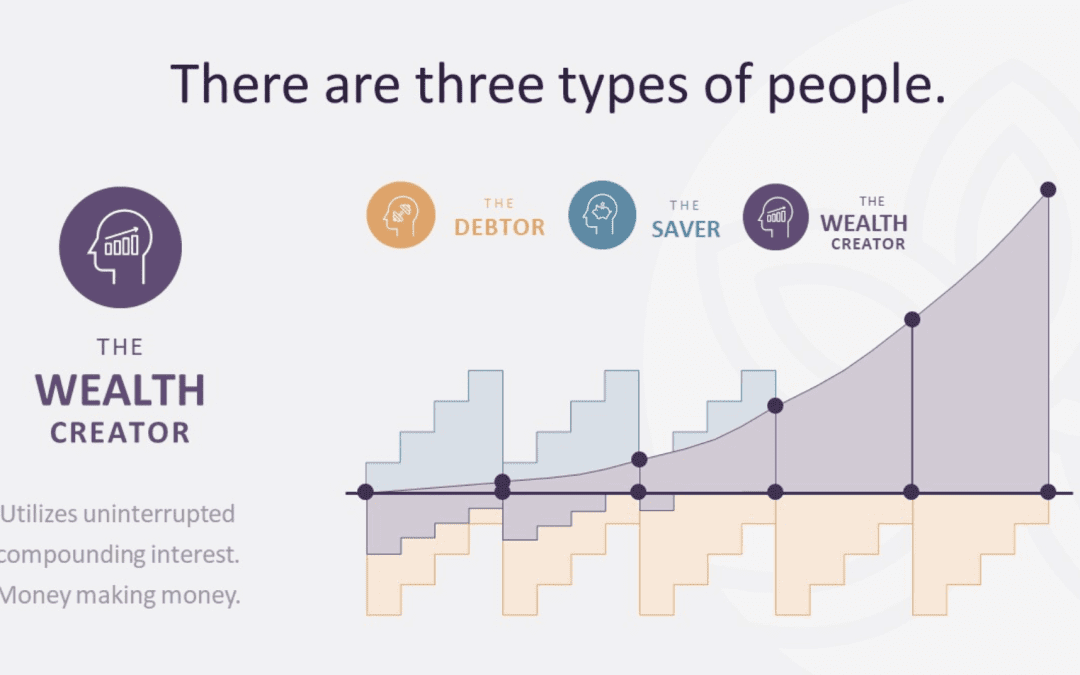

The strategy has its own advantages, however it likewise has issues with high fees, intricacy, and extra, causing it being related to as a fraud by some. Unlimited financial is not the most effective plan if you need just the investment component. The infinite banking idea focuses on making use of whole life insurance policies as a monetary device.

A PUAR enables you to "overfund" your insurance plan right up to line of it coming to be a Changed Endowment Agreement (MEC). When you utilize a PUAR, you quickly increase your money value (and your death advantage), therefore raising the power of your "bank". Even more, the more cash money value you have, the higher your interest and returns repayments from your insurer will be.

With the rise of TikTok as an information-sharing system, monetary advice and methods have actually discovered a novel means of dispersing. One such method that has actually been making the rounds is the infinite banking idea, or IBC for brief, gathering recommendations from celebs like rap artist Waka Flocka Fire - Financial independence through Infinite Banking. While the method is currently prominent, its roots trace back to the 1980s when economist Nelson Nash presented it to the globe.

What are the common mistakes people make with Infinite Banking?

Within these policies, the cash worth expands based upon a rate established by the insurer. As soon as a substantial cash money worth builds up, insurance holders can obtain a cash value finance. These loans vary from standard ones, with life insurance policy working as security, indicating one could lose their coverage if loaning excessively without adequate money value to support the insurance policy prices.

And while the allure of these policies is obvious, there are innate constraints and dangers, necessitating attentive cash money value monitoring. The approach's authenticity isn't black and white. For high-net-worth individuals or local business owner, particularly those utilizing techniques like company-owned life insurance policy (COLI), the benefits of tax obligation breaks and substance development could be appealing.

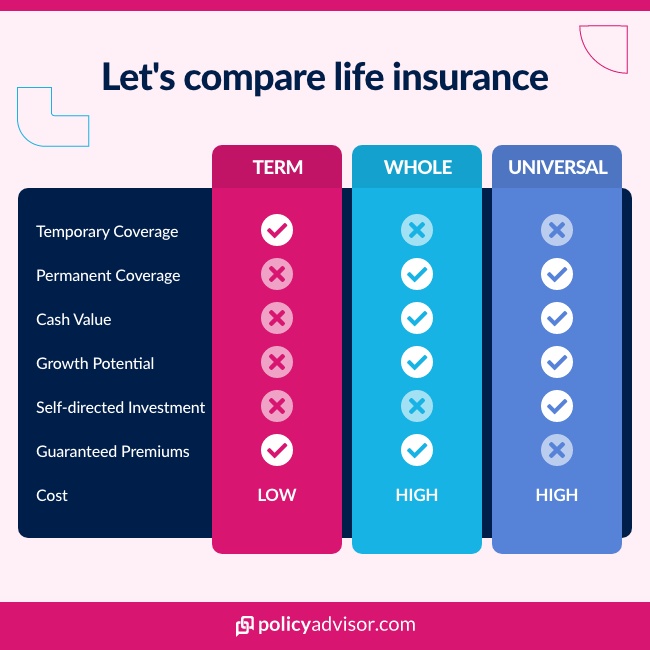

The appeal of infinite banking does not negate its difficulties: Expense: The foundational demand, an irreversible life insurance policy plan, is pricier than its term counterparts. Qualification: Not everybody certifies for whole life insurance coverage due to rigorous underwriting processes that can leave out those with particular wellness or way of life conditions. Intricacy and danger: The intricate nature of IBC, combined with its dangers, may discourage several, especially when simpler and much less dangerous choices are readily available.

Can I access my money easily with Privatized Banking System?

Alloting around 10% of your monthly revenue to the plan is simply not practical for the majority of people. Using life insurance policy as an investment and liquidity resource requires technique and monitoring of policy cash money worth. Get in touch with a financial expert to determine if boundless financial aligns with your concerns. Part of what you check out below is just a reiteration of what has already been said over.

Prior to you obtain yourself right into a circumstance you're not prepared for, know the following first: Although the principle is typically marketed as such, you're not in fact taking a loan from on your own. If that held true, you wouldn't have to settle it. Instead, you're borrowing from the insurance coverage business and have to settle it with interest.

Some social media posts suggest making use of cash worth from whole life insurance policy to pay down credit card financial debt. When you pay back the car loan, a portion of that rate of interest goes to the insurance firm.

Is there a way to automate Infinite Banking Cash Flow transactions?

For the initial a number of years, you'll be paying off the payment. This makes it incredibly challenging for your policy to accumulate worth during this time around. Entire life insurance prices 5 to 15 times extra than term insurance coverage. Lots of people simply can't manage it. Unless you can manage to pay a couple of to numerous hundred dollars for the next decade or more, IBC will not function for you.

Not everyone must depend entirely on themselves for financial safety. Tax-free income with Infinite Banking. If you call for life insurance policy, right here are some beneficial suggestions to think about: Consider term life insurance policy. These plans offer insurance coverage during years with significant monetary commitments, like home mortgages, trainee car loans, or when looking after young kids. Make certain to search for the finest rate.

Can I use Financial Leverage With Infinite Banking for my business finances?

Think of never having to bother with small business loan or high rates of interest again. Suppose you could obtain money on your terms and develop wealth concurrently? That's the power of limitless financial life insurance policy. By leveraging the cash value of whole life insurance coverage IUL policies, you can grow your riches and obtain money without counting on typical financial institutions.

There's no set financing term, and you have the liberty to pick the repayment timetable, which can be as leisurely as settling the car loan at the time of fatality. This adaptability prolongs to the servicing of the car loans, where you can choose for interest-only payments, keeping the finance balance level and convenient.

How long does it take to see returns from Infinite Banking Concept?

Holding cash in an IUL fixed account being credited rate of interest can frequently be far better than holding the cash money on deposit at a bank.: You have actually always imagined opening your own bakeshop. You can obtain from your IUL policy to cover the initial costs of leasing a space, acquiring devices, and employing team.

Individual loans can be obtained from typical banks and credit rating unions. Obtaining money on a credit history card is generally very costly with annual percentage prices of interest (APR) usually getting to 20% to 30% or even more a year.

Latest Posts

Generation Bank: Front Page

Infinite Banking Definition

Ibc Concept