All Categories

Featured

Table of Contents

A PUAR enables you to "overfund" your insurance plan right up to line of it coming to be a Customized Endowment Agreement (MEC). When you utilize a PUAR, you quickly enhance your cash money worth (and your survivor benefit), thereby enhancing the power of your "bank". Even more, the more cash money value you have, the better your interest and dividend settlements from your insurance provider will be.

With the rise of TikTok as an information-sharing system, financial recommendations and methods have discovered a novel means of spreading. One such method that has actually been making the rounds is the infinite banking concept, or IBC for short, garnering endorsements from celebrities like rapper Waka Flocka Fire. Nonetheless, while the approach is presently preferred, its roots map back to the 1980s when economic expert Nelson Nash presented it to the globe.

Can Infinite Banking Wealth Strategy protect me in an economic downturn?

Within these policies, the money value grows based on a rate set by the insurance firm (Wealth management with Infinite Banking). Once a significant cash value collects, policyholders can acquire a money worth car loan. These lendings vary from conventional ones, with life insurance policy functioning as collateral, indicating one might shed their insurance coverage if loaning excessively without ample cash money worth to support the insurance expenses

And while the attraction of these plans is noticeable, there are innate constraints and threats, necessitating thorough cash money worth surveillance. The strategy's legitimacy isn't black and white. For high-net-worth people or business owners, specifically those using techniques like company-owned life insurance policy (COLI), the advantages of tax obligation breaks and compound growth could be appealing.

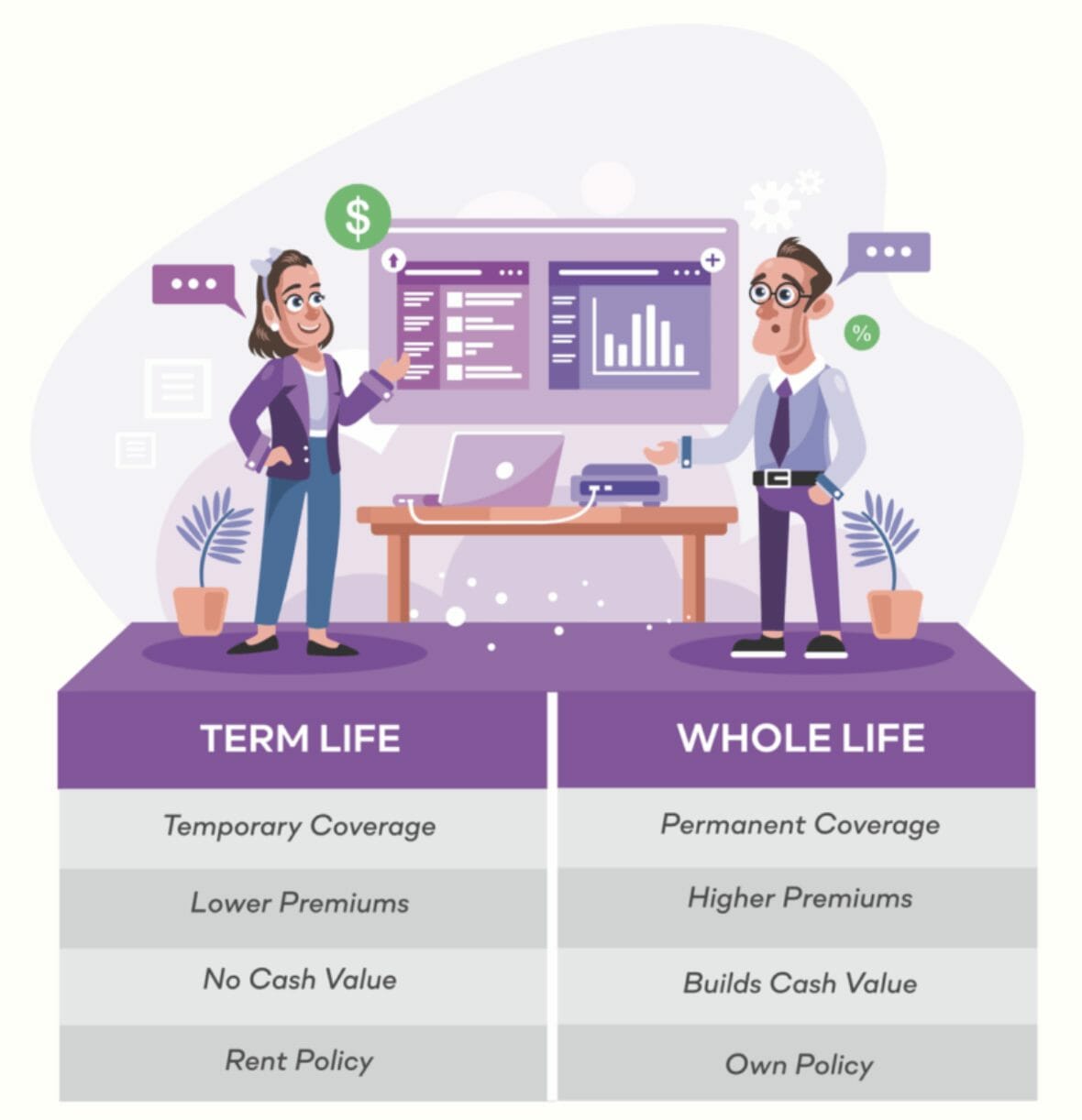

The attraction of limitless banking doesn't negate its obstacles: Expense: The foundational demand, a long-term life insurance coverage plan, is costlier than its term counterparts. Qualification: Not everybody receives whole life insurance coverage because of extensive underwriting processes that can omit those with particular health and wellness or way of life problems. Intricacy and risk: The intricate nature of IBC, coupled with its dangers, may prevent many, particularly when easier and less risky options are readily available.

What resources do I need to succeed with Cash Flow Banking?

Designating around 10% of your regular monthly revenue to the plan is just not viable for a lot of individuals. Part of what you check out below is merely a reiteration of what has already been said above.

Before you get on your own right into a situation you're not prepared for, know the complying with first: Although the concept is commonly marketed as such, you're not really taking a loan from yourself. If that held true, you would not need to settle it. Instead, you're borrowing from the insurance provider and need to repay it with rate of interest.

Some social networks articles suggest utilizing cash value from whole life insurance policy to pay down bank card debt. The idea is that when you repay the loan with passion, the amount will certainly be returned to your financial investments. That's not how it works. When you pay back the loan, a part of that interest mosts likely to the insurance provider.

For the first several years, you'll be paying off the commission. This makes it exceptionally hard for your plan to accumulate value during this time. Unless you can pay for to pay a couple of to several hundred bucks for the following decade or more, IBC won't work for you.

Tax-free Income With Infinite Banking

Not everybody ought to rely solely on themselves for economic security. If you need life insurance policy, here are some useful suggestions to take into consideration: Think about term life insurance policy. These plans offer coverage throughout years with considerable monetary responsibilities, like home mortgages, student car loans, or when taking care of young children. Make certain to look around for the best rate.

Think of never needing to bother with bank car loans or high interest prices once more. What if you could borrow money on your terms and build wealth at the same time? That's the power of limitless financial life insurance policy. By leveraging the money worth of entire life insurance policy IUL policies, you can grow your wealth and borrow cash without depending on standard banks.

There's no set loan term, and you have the liberty to choose the settlement schedule, which can be as leisurely as paying off the car loan at the time of death. Cash value leveraging. This flexibility extends to the servicing of the lendings, where you can choose interest-only payments, maintaining the lending balance flat and manageable

Holding cash in an IUL taken care of account being attributed rate of interest can often be better than holding the cash on down payment at a bank.: You have actually constantly desired for opening your own pastry shop. You can borrow from your IUL plan to cover the initial expenses of renting an area, purchasing devices, and working with personnel.

How flexible is Cash Flow Banking compared to traditional banking?

Personal fundings can be obtained from traditional financial institutions and lending institution. Here are some bottom lines to think about. Charge card can supply a versatile means to obtain money for very short-term durations. Obtaining money on a credit rating card is usually extremely expensive with yearly percent prices of interest (APR) commonly reaching 20% to 30% or even more a year.

Latest Posts

Generation Bank: Front Page

Infinite Banking Definition

Ibc Concept