All Categories

Featured

Table of Contents

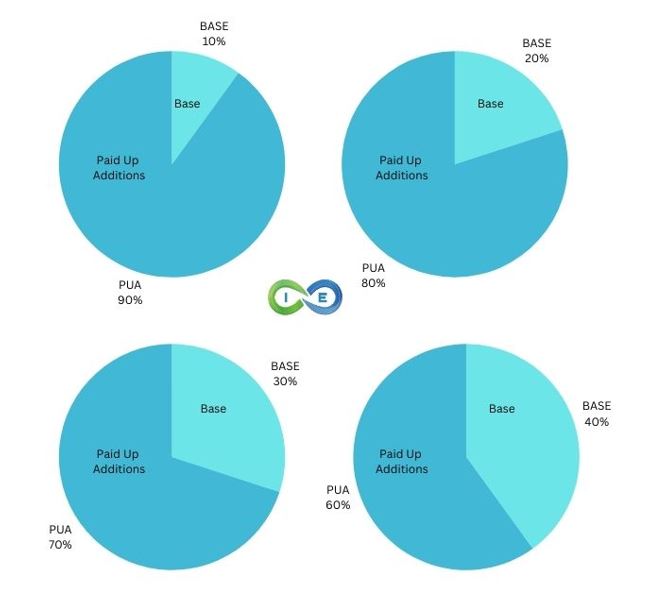

A PUAR enables you to "overfund" your insurance policy right approximately line of it coming to be a Changed Endowment Contract (MEC). When you utilize a PUAR, you rapidly raise your cash money value (and your fatality advantage), therefore raising the power of your "financial institution". Additionally, the more cash worth you have, the better your rate of interest and dividend payments from your insurance provider will certainly be.

With the increase of TikTok as an information-sharing system, financial suggestions and techniques have actually discovered a novel means of dispersing. One such approach that has actually been making the rounds is the infinite financial principle, or IBC for short, amassing recommendations from celebrities like rap artist Waka Flocka Fire. While the approach is presently popular, its roots trace back to the 1980s when economic expert Nelson Nash introduced it to the globe.

How do I optimize my cash flow with Infinite Banking Vs Traditional Banking?

Within these plans, the cash value expands based upon a rate established by the insurance provider (Life insurance loans). When a considerable cash value gathers, insurance policy holders can get a money worth financing. These fundings differ from standard ones, with life insurance offering as security, suggesting one might lose their insurance coverage if loaning excessively without ample money value to support the insurance coverage costs

And while the appeal of these plans appears, there are innate restrictions and risks, demanding attentive cash worth monitoring. The strategy's authenticity isn't black and white. For high-net-worth people or local business owner, particularly those using strategies like company-owned life insurance policy (COLI), the advantages of tax obligation breaks and compound growth can be appealing.

The appeal of boundless financial doesn't negate its difficulties: Cost: The foundational need, an irreversible life insurance plan, is more expensive than its term counterparts. Qualification: Not everyone gets approved for whole life insurance policy due to strenuous underwriting processes that can omit those with particular health and wellness or way of living problems. Complexity and danger: The elaborate nature of IBC, combined with its threats, may deter numerous, especially when less complex and much less high-risk choices are readily available.

What is the best way to integrate Wealth Management With Infinite Banking into my retirement strategy?

Assigning around 10% of your regular monthly earnings to the policy is simply not feasible for the majority of people. Part of what you read below is simply a reiteration of what has actually already been stated over.

Prior to you obtain yourself right into a scenario you're not prepared for, recognize the complying with first: Although the concept is commonly sold as such, you're not really taking a car loan from on your own. If that held true, you wouldn't need to settle it. Instead, you're obtaining from the insurance provider and need to settle it with interest.

Some social media messages recommend making use of cash worth from whole life insurance policy to pay down credit history card financial debt. When you pay back the loan, a portion of that interest goes to the insurance policy business.

For the first a number of years, you'll be settling the payment. This makes it very difficult for your policy to build up value during this moment. Entire life insurance policy costs 5 to 15 times a lot more than term insurance policy. Most individuals simply can't afford it. Unless you can manage to pay a couple of to a number of hundred dollars for the next decade or more, IBC won't function for you.

Infinite Banking is not just for entrepreneurs—it’s a key strategy for creating generational wealth.

Parents can use Infinite Banking to fund their children’s education, all while ensuring long-term wealth growth.

Legacy planning experts assist in structuring Infinite Banking policies - does infinite banking work for high-income earners. Schedule a consultation today to set up a tax-free financial system

What are the risks of using Wealth Building With Infinite Banking?

Not everybody needs to depend only on themselves for monetary safety. If you require life insurance policy, here are some valuable tips to take into consideration: Consider term life insurance policy. These plans give protection throughout years with substantial economic commitments, like home mortgages, pupil finances, or when taking care of children. Make sure to search for the very best rate.

Imagine never ever having to fret regarding small business loan or high rate of interest once again. What if you could obtain money on your terms and construct wide range all at once? That's the power of limitless banking life insurance policy. By leveraging the cash money value of whole life insurance policy IUL policies, you can expand your wealth and obtain money without relying on typical financial institutions.

There's no set loan term, and you have the liberty to make a decision on the payment routine, which can be as leisurely as paying back the lending at the time of fatality. Infinite Banking. This versatility reaches the servicing of the fundings, where you can choose for interest-only payments, keeping the lending equilibrium flat and manageable

Holding money in an IUL fixed account being attributed rate of interest can usually be better than holding the cash money on deposit at a bank.: You've constantly desired for opening your own bakeshop. You can borrow from your IUL policy to cover the first expenses of renting out a space, acquiring equipment, and hiring team.

How does Wealth Management With Infinite Banking create financial independence?

Individual fundings can be gotten from typical banks and credit report unions. Here are some bottom lines to think about. Charge card can provide an adaptable way to borrow money for extremely temporary durations. Obtaining cash on a debt card is typically very costly with yearly percentage prices of passion (APR) often reaching 20% to 30% or even more a year.

Table of Contents

Latest Posts

Generation Bank: Front Page

Infinite Banking Definition

Ibc Concept

More

Latest Posts

Generation Bank: Front Page

Infinite Banking Definition

Ibc Concept